aravogel937003

About aravogel937003

The Comprehensive Guide To Gold IRA Transfers: Maximizing Your Retirement Wealth

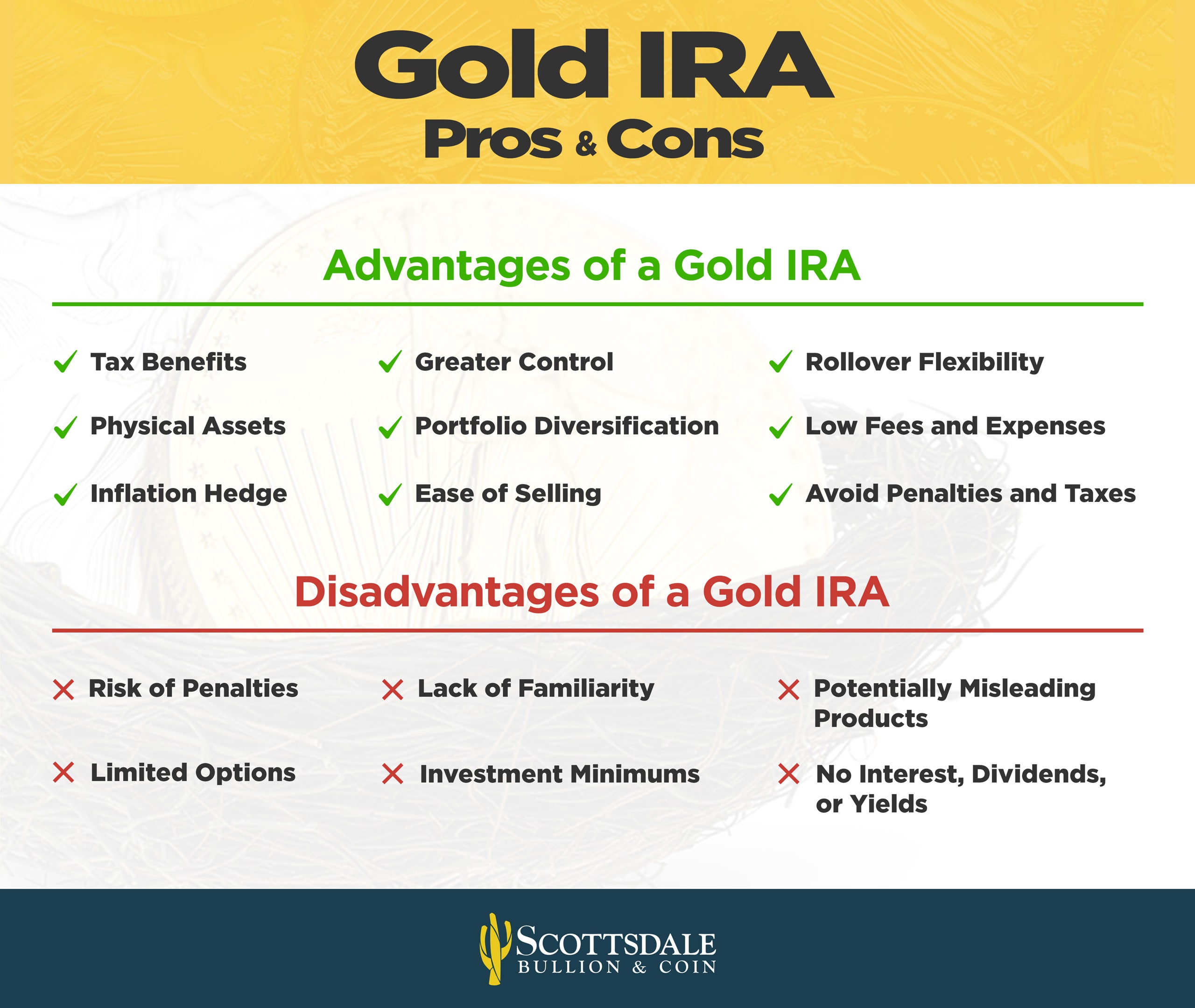

In the realm of retirement planning, Individual Retirement Accounts (IRAs) have long been a cornerstone for constructing a secure monetary future. Among the assorted types of IRAs out there, Gold IRAs have gained vital recognition attributable to their potential for wealth preservation and inflation hedging. A Gold IRA allows traders to hold physical gold, silver, platinum, and palladium in a tax-advantaged account. Here is more information about gold-ira.Info take a look at our web site. Nevertheless, understanding the means of transferring an present IRA into a Gold IRA is essential for maximizing your retirement wealth. This text will delve into the intricacies of Gold IRA transfers, exploring their advantages, the process concerned, and key issues to remember.

Understanding Gold IRAs

Earlier than we discuss the switch process, it’s essential to understand what a Gold IRA is. A Gold IRA is a self-directed IRA that invests in physical precious metals, unlike traditional IRAs, which sometimes hold stocks, bonds, and mutual funds. Buyers are interested in Gold IRAs for a number of reasons:

- Inflation Hedge: Gold has historically been a reliable hedge against inflation, maintaining its worth even during financial downturns.

- Diversification: Together with valuable metals in your investment portfolio can provide diversification, decreasing general risk.

- Wealth Preservation: Gold is a tangible asset that can preserve wealth over time, making it a sexy option for retirement planning.

Why Transfer to a Gold IRA?

Transferring an present IRA to a Gold IRA could be a strategic transfer for investors searching for to enhance their retirement portfolio. Some key causes for making the swap embody:

- Market Volatility Safety: Gold tends to carry out well during occasions of financial uncertainty, offering a buffer in opposition to market volatility.

- Lengthy-Term Progress Potential: As global demand for gold increases, its worth may recognize over time, contributing to long-term development.

- Tax Advantages: Like traditional IRAs, Gold IRAs provide tax-deferred growth, meaning you won’t pay taxes in your positive aspects until you withdraw funds in retirement.

The Gold IRA Transfer Course of

Transferring an current IRA to a Gold IRA includes a number of steps, every requiring careful consideration to make sure compliance with IRS rules. Here’s a detailed breakdown of the transfer course of:

- Select a reputable Gold IRA Custodian: The first step in the transfer process is deciding on a custodian that focuses on Gold IRAs. This custodian will handle the administrative tasks related with your Gold IRA, including the purchase and storage of valuable metals. It’s crucial to choose a custodian with a stable status, transparent charge constructions, and glorious customer service.

- Open a Gold IRA Account: Once you’ve chosen a custodian, you’ll have to open a Gold IRA account. This course of typically involves filling out an software and offering needed documentation, comparable to identification and proof of current retirement accounts.

- Initiate the Switch: After your Gold IRA account is established, you possibly can provoke the transfer of funds from your present IRA. This is usually executed by means of a direct transfer, the place the funds are moved instantly from one custodian to another with out you ever taking possession of the money. This methodology avoids any tax implications and penalties.

- Choose Your Precious Metals: Once the funds are transferred, you’ll be able to begin selecting the treasured metals you would like to incorporate in your Gold IRA. The IRS has particular pointers concerning the sorts of metals that qualify for inclusion in a Gold IRA, so make sure to consult together with your custodian to ensure compliance.

- Buy and Store Your Metals: After choosing your metals, your custodian will facilitate the purchase and be certain that the metals are stored in an accredited depository. It’s essential to choose a secure and reputable storage facility to safeguard your investment.

- Monitor Your Investment: After the switch and purchase are complete, it’s important to repeatedly monitor your Gold IRA to make sure it aligns together with your retirement goals. Stay informed about market tendencies and consider consulting with a financial advisor to make knowledgeable selections about your funding strategy.

Key Concerns

While transferring to a Gold IRA can be useful, there are a number of key concerns to keep in mind:

- Charges and Prices: Completely different custodians cost varying charges for account setup, storage, and transactions. Make certain to know the price structure earlier than proceeding with a switch.

- Tax Implications: While direct transfers are tax-free, oblique transfers (the place you take possession of the funds) can set off tax liabilities and penalties. Always consult with a tax professional to understand the implications of your switch.

- Funding Selections: The IRS has specific requirements for the kinds of metals that can be held in a Gold IRA. Be sure that your chosen valuable metals meet these requirements to avoid potential points.

- Market Dangers: Whereas gold can be a stable investment, it’s not immune to market fluctuations. Be prepared for potential volatility and consider the way it matches into your general investment technique.

Conclusion

Transferring an existing IRA to a Gold IRA generally is a strategic transfer for buyers trying to diversify their retirement portfolios and protect their wealth in opposition to financial uncertainty. By understanding the switch process, selecting a reputable custodian, and being conscious of key issues, you can maximize the advantages of a Gold IRA. As with any funding decision, it’s important to conduct thorough analysis and consult with monetary professionals to make sure that your choices align together with your lengthy-term monetary goals. With careful planning and informed decisions, a Gold IRA is usually a invaluable part of your retirement technique, offering stability and potential development in an ever-altering monetary landscape.

No listing found.